How to Start Staking With Polli

Reading Time - 9 min

Crypto staking is a popular way to earn passive income. But for most users, staking still feels anything but passive.

Choosing validators, tracking performance, and avoiding slashing risks can be overwhelming.

This is where Polli comes in.

Polli simplifies staking with AI-powered optimization, helping you earn the best yields with the least effort.

What is Polli?

Polli is a non-custodial staking optimization platform that helps you maximize staking rewards through Artificial Intelligence (AI) driven decision-making.

Think of Polli as your copilot for staking. The AI agent works in the background while your assets remain entirely under your control.

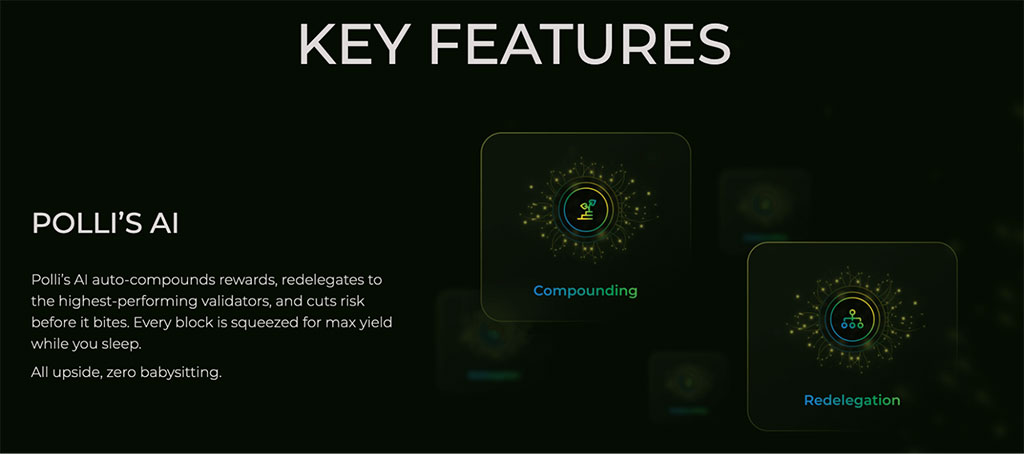

Here’s a high-level view of what you get with Polli’s AI staking agent:

- Auto-compounding of staking rewards (Cosmos only)

- Validator selection

- Intelligent validator redelegation when opportunities arise

- Contribution to network decentralization

All these services combine to give you above-market staking returns.

Polli supports staking across multiple networks, including Cosmos Hub (ATOM), Lava Network (LAVA and Osmosis (OSMO).

The Future of Staking is AI – Elay Carmon (Polli)

Who Is Polli For?

Polli is built for a wide range of users, from beginners to advanced stakers.

-

- New Stakers: No need to research dozens of validators or manually compound staking rewards.

- Long-Term Holders: Polli ensures your long-term holdings are working efficiently. Instead of staking and forgetting with a single validator, the platform actively optimizes your staked assets.

- Teams and Treasuries: Polli is also designed for teams that need reliable, optimized staking without operational overhead. This makes it a strong fit for treasury management.

How to Start Staking with Polli

Here’s a simple step-by-step walkthrough.

Step 1: Visit Polli

Start by heading to Polli.co. From there, you can browse through the platform and learn which networks are currently supported for staking.

You can also read through the website to get more familiar with the team, key features and frequently asked questions.

Step 2: Explore the Staking Calculator

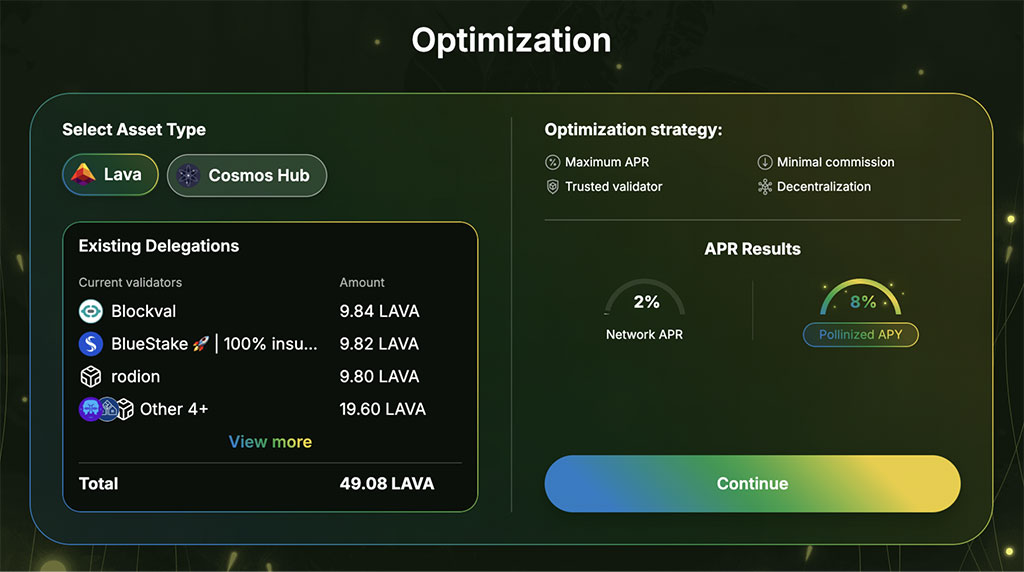

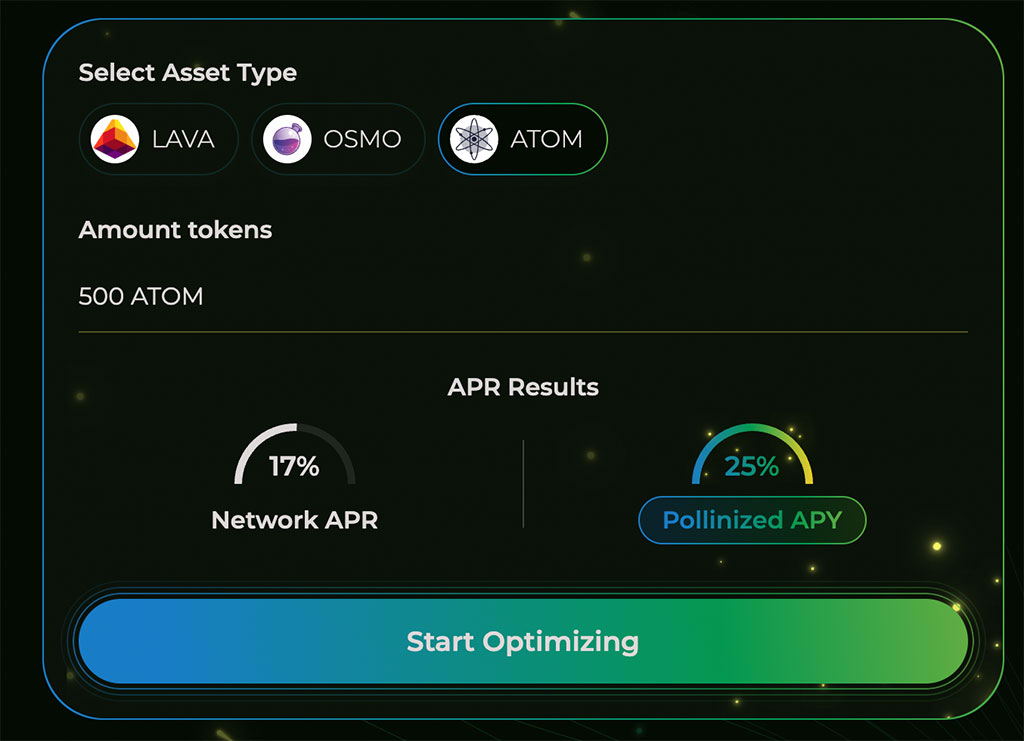

Explore Polli’s above-market returns using the website’s staking calculator. To optimize your holdings, click “Start optimizing” to begin the staking optimization process

Play around with the calculator to estimate potential rewards. This tool helps you understand expected returns based on staking size.

While actual yields vary, Polli typically delivers yields 15%-30% higher than unmanaged native staking.

Step 3: Launch the App

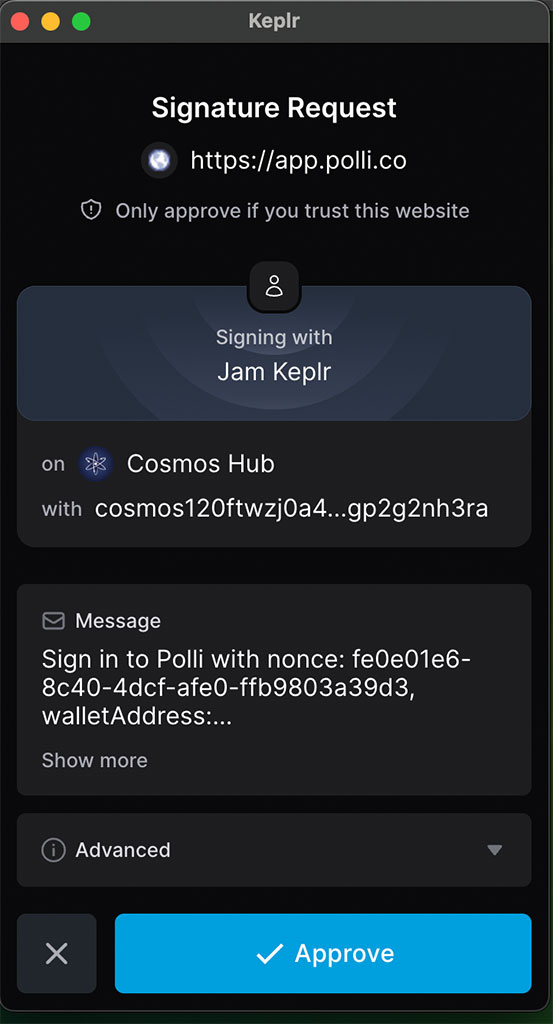

Upon clicking Launch App, the site will prompt you to connect a wallet.

Make sure you’re using a compatible wallet such as Keplr or another supported wallet.

Connect your wallet and approve the connection through your wallet interface. Polli never takes custody of your assets; it only receives permission to interact with your wallet for staking operations.

Once connected, you’ll see your available token balances for supported networks.

Step 4: Delegate and Start Staking

Select the network you want to stake on, such as Lava Network, and click Delegate.

This is where Polli’s advantage becomes clear. Rather than manually selecting a validator, Polli prepares an optimized strategy based on real-time performance data. Alternatively, you can view the full list of validators by clicking the “Edit” button, where you can add or remove as many validators as you like and use filtering options to refine your selection.

Once you’re ready, delegate your tokens.

Step 5: Monitor and Optimize Automatically

After staking, Polli continues working in the background by auto-compounding your rewards and evaluating validator performance. Should a better opportunity appear, Polli will also redelegate your stake.

You can monitor performance anytime through the Polli dashboard without taking any manual action.

Start Staking With Polli Today

Staking doesn’t have to be complex or time-consuming. With Polli, you gain access to AI-powered staking optimization.

Whether you’re experimenting with automated compounding or simply looking for a smarter way to earn passive income, Polli offers a streamlined, transparent staking experience.

Ready to start optimizing from day one? Head over to Polli and get the most out of your staked assets.

FAQs

Is Polli Safe?

Yes. Polli is a non-custodial platform, meaning we never take control of your assets. Your funds remain in your wallet and under your sole ownership at all times.

Most importantly: Polli will never ask for your private keys or seed phrase. You retain 100% control of your security, significantly reducing counterparty risk and ensuring complete transparency.

How Much Does It Cost to Use Polli?

Polli wins when you win. Polli charges a commission only if the AI generates returns that exceed the standard network APR. This commission is a portion of that “over-performance” (the extra profit generated for you). If Polli doesn’t beat the market, you don’t pay a commission. Please note that standard network gas and transaction fees still apply.

What is a Redelegation?

Redelegation allows you to move your staked tokens from one validator to another instantly, without having to wait for the standard unbonding period.

Why do Redelegations Happen?

Polli’s AI continuously monitors the network’s health and performance to ensure your assets are always in the best possible position. Redelegations are triggered automatically for several key reasons:

- Maximizing Yield: If another reputable validator offers a lower commission or higher performance, Polli may move your stake to capture that better return.

- Validator Health & Uptime: If your current validator goes offline or has “downtime,” they stop earning rewards. Polli detects this immediately and moves your assets to an active validator so you don’t miss a single block of rewards.

- Risk Mitigation: If a validator fails to meet network standards, and is in risk of “slashing” (a penalty where a portion of staked tokens is lost). Polli monitors these risk signals and redelegates your funds away from “at-risk” validators to protect your principal.

What Happens to My Rewards After Staking?

Polli uses an automated compounding strategy to ensure your rewards are working for you 24/7. The AI calculates the mathematically optimal frequency for redelegating your rewards, maximizing your APY while ensuring network fees don’t erode your gains. All rewards remain on-chain and are viewable at any time through your dashboard.

Does Polli Have a Staking Calculator?

Yes. Polli provides a real-time staking calculator to help you estimate potential rewards. To give you the most accurate projection, the calculator factors in your specific token, staked amount, and current network conditions. Because network APRs and gas prices fluctuate constantly, these figures are estimates based on current data. They are valid at the time of calculation and do not guarantee future performance.

Which wallets are supported on Polli?

Polli supports a wide range of popular browser extensions, mobile wallets, and hardware security modules:

- Browser Extensions: Keplr, Leap, and Cosmostation.

- Hardware Wallets: We offer full support for Ledger and other hardware wallets. Because Polli is non-custodial, you can use your Ledger to sign transactions while keeping your private keys entirely offline for maximum security.

Which networks does Polli support?

We currently support AI-powered optimization for, ATOM, LAVA, KiiChain, SCRT, and OSMO. Our team is actively working to integrate more ecosystems, so keep an eye out for upcoming network launches.

January 27, 2026

January 27, 2026