Introducing Polli: Staking Optimization and Auto Compounding

Reading Time - 7 min

What Is Auto-Compounding And How Does It Work?

Crypto staking is one of the most groundbreaking innovations in blockchain.

In the early days of crypto, you needed expensive mining rigs and massive electricity to help secure a network. Now, staking allows anyone to contribute to blockchain security and consensus, with just a few clicks.

But while staking has become easier, getting the best staking returns hasn’t.

Even if your network promises high APY, most users walk away with far less.

Maximizing staking yield isn’t just about locking your tokens. It’s about staking optimization: choosing the right validators, minimizing fees, compounding rewards, and staying active. And without the right tools, it’s easy to leave returns on the table.

Where Do My Staking Returns Go?

If you’ve ever staked and felt like your returns were underwhelming, you’re not imagining it.

Take Cosmos Hub (ATOM), for example. While the network may advertise a 16% APY, many stakers earn significantly less. To understand why, let’s unpack where staking returns actually go and what causes the gap.

Not All Validators Give the Same Returns

Staking in Cosmos is straightforward at first glance: delegate your tokens to a validator and start earning rewards. But beneath that simplicity lies a complex decision. Not all validators give the same returns.

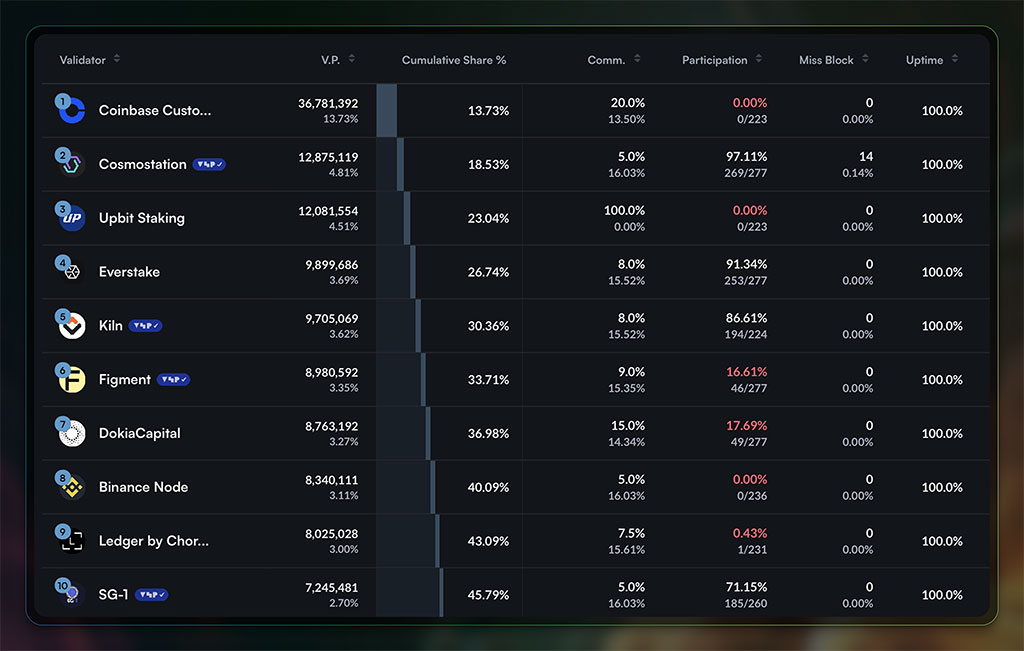

Take a look at the table above from Mintscan.

Centralized exchanges like Coinbase and Upbit might seem like wise picks. However, they charge high commission rates, up to 100%, which means you get nothing.

Other validators may suffer from downtime, reducing their staking efficiency and, consequently, your earnings.

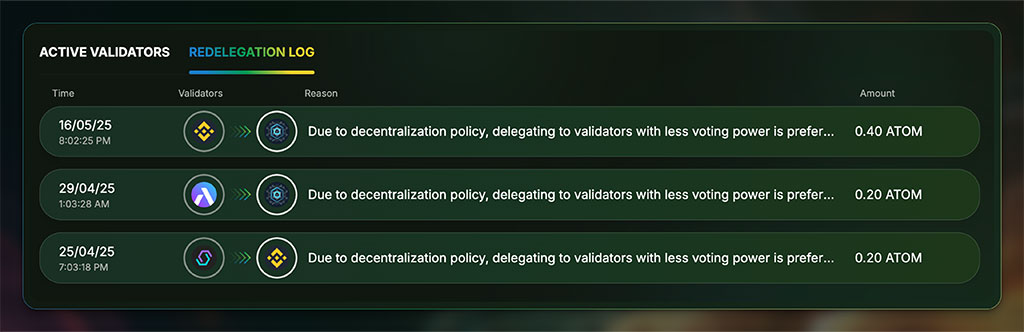

Finally, there’s the issue of centralization. Delegating to validators with too much voting power may seem like the safe option, but it contributes to network centralization. If you’re in crypto for its principles, then this goes against the ethos of decentralization.

Manual Compounding Leaves Money on the Table

Even if you’ve chosen a strong validator, you still need to manage your staking position.

Cosmos staking is not auto-compounded. You must manually:

- Monitor your rewards

- Decide when to claim (without wasting gas fees)

- Stake those rewards to compound returns

If you miss this step, or do it inconsistently, your assets sit idle. Over time, this lost compounding adds up and creates a meaningful gap between your actual returns and the network APY.

In staking, every basis point counts.

The 8th Wonder of the World: Compounding

Compounding staking rewards means earned rewards on top of your staking crypto rewards. Essentially, it’s “staking rewards on staking rewards.” The power of compounding lies in its exponential growth potential, making it a powerful tool for long-term investments.

Let’s say you have 1,000 ATOM tokens staked with a reward rate of 5% after validator commissions

- You earn 50 ATOM tokens in the first year.

- In total your balance has grown to 1,050 ATOM.

- Assume you stake the 50 ATOM.

- In the second year, the staking rewards are calculated on the new total of 1,050 ATOM, bringing your rewards to 52.50 ATOM and so on.

Now, the more frequently you compound, the better. Instead of staking your rewards after a full year, what if you staked them as soon as they were made available to you? The staking reward rate increases even further.

How to Get More Staking Rewards with Polli

Polli is built to help you earn above-market rewards with less effort.

With just a few clicks, Polli’s Artificial Intelligence (AI)-powered staking platform automates your staking strategy, from validator selection to auto-compounding and redelegation.

You don’t need spreadsheets or constant wallet checks. Just stake confidently and let Polli do the heavy lifting.

Proprietary Validator Scoring

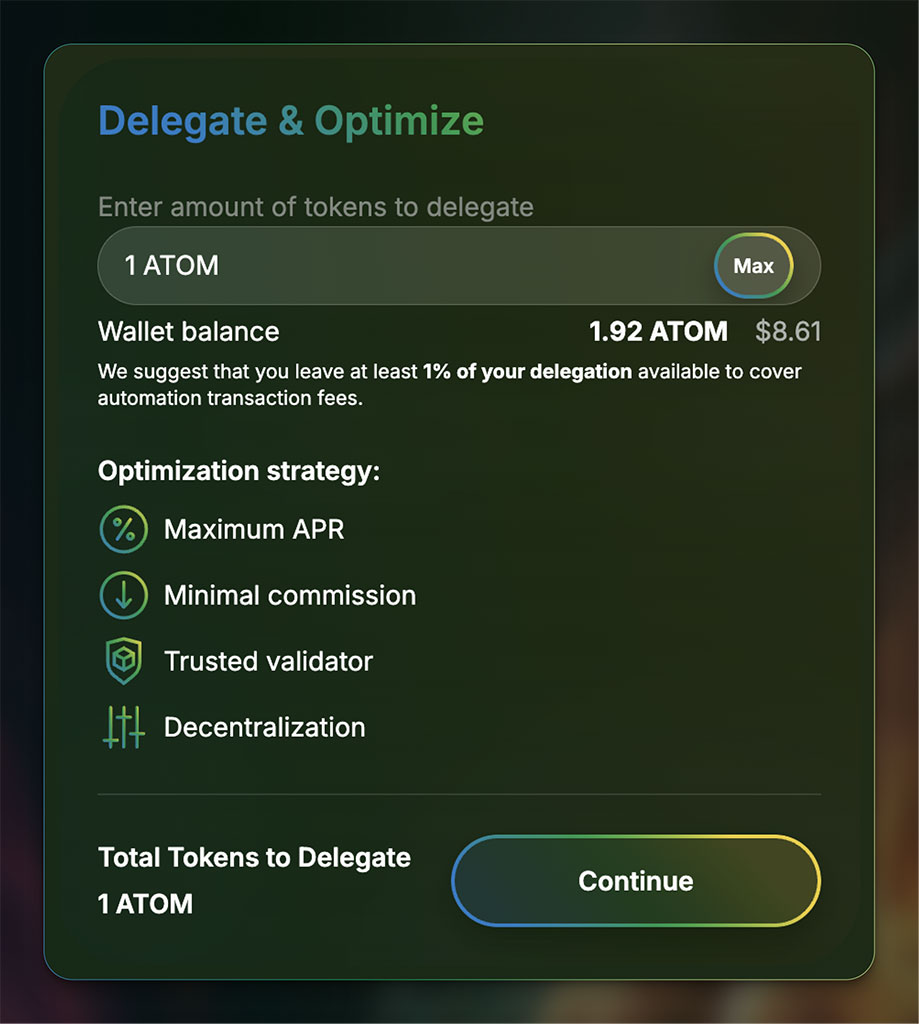

Not sure which validators to trust? Polli’s AI agents optimize across four key areas:

- Maximum APR: Polli scans the network for validators offering the highest possible yield.

- Minimal Commission: Polli filters out high-fee validators and prioritizes those that carry low commissions.

- Trust: Not all validators are created equal. Some have a history of downtime, missed blocks, or even slashing events. Polli’s scoring engine reviews validator performance.

- Decentralization: Polli actively avoids delegating to validators with excessive voting power to prevent network centralization

It’s not just about the highest return. Polli helps you earn sustainably, without compromising network health or putting your assets at risk.

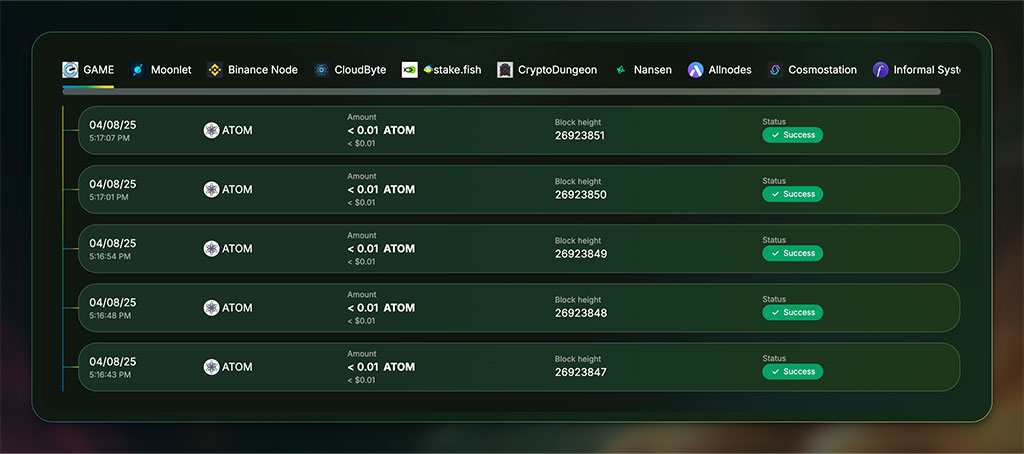

Auto-Compound Staking Rewards with Polli

Polli automates the claiming and compounding of your staking rewards. So, you never miss an opportunity to earn more.

Staking on some networks (e.g. Ethereum) can impose challenges with gas fees. Depending on network conditions, gas fees can spike, reducing your effective rewards rate.

Polli has a dynamic compounder that takes into account network conditions and the amount of tokens for staking. Polli finds the best balance for the highest yield and lowest fees.

Polli gives you transparency. You can view logs of your staking rewards across each validator, track your performance, and watch your earnings grow in real time.

With its dynamic redelegation, Polli protects your assets from underperforming validators while helping you support network decentralization.

Stake Now with Polli

Staking doesn’t have to be complicated or inefficient.

With Polli, you get above-market yields, smart validator selection, and consistent auto-compounding, all in one platform.

Whether you’re a first-time staker or a yield-maximizing pro, Polli helps you get the most out of your tokens.

August 21, 2025

August 27, 2025